Insurance companies have to take into consideration how pricey the cars and truck is to change or repair. With non-owner car insurance coverage, your driving history is the most crucial factor in determining your costs. The price for non-owner insurance coverage can likewise differ depending on your age, how often you plan to drive and various other factors that could flag you as risky in the eyes of insurance providers.

Keeping accounts open likewise expands the length of time you've had credit scores, which is another aspect in your credit rating. Is Non-Owner Vehicle Insurance Right for You? If you do not own your own cars and truck however often drive your buddies' automobiles, use car-sharing solutions or lease vehicles, non-owner automobile insurance policy can use added defense.

Vehicle insurance is only necessary if you have and drive a cars and truck. If you do not have a cars and truck, you aren't legally required to have insurance coverage.

There can be instances in which the expenses exceed the coverage limitations. Non owner auto insurance coverage will help you cover the exceeded quantity - money.

If you desire this kind of protection, be certain to inquire about it when requesting quotes. Some non-owner policies will additionally give obligation protection for rental vehicles. cheaper. Check out the small print on your non-owner policy if you mean to utilize it for rental cars, as well as see to it it actually covers you when you're driving one.

The Ultimate Guide To Non Owner Auto Insurance

auto insurance perks vehicle insurance cheaper

auto insurance perks vehicle insurance cheaper

What Is Employed and also Non-Owned Auto? Several entrepreneur make use of cars for work that they don't have. Whether you're leasing, leasing or borrowing an auto for business objectives, you'll deal with threats on the road. That's where hired and non-owned auto insurance coverage (HNOA) can aid. As a sort of small company insurance policy, HNOA can assist cover residential or commercial property damage or physical injury that your service caused to somebody else in a crash.

insurance risks dui cheap insurance

insurance risks dui cheap insurance

It can help spend for any kind of residential property damages that leased lorries trigger while being made use of for your service. It additionally covers vehicles used for your company if they create physical injury to another vehicle driver in an automobile mishap - auto. Typical Inquiries About Worked With and Non-Owned Auto What Is the Difference Between Worked With and also Non-Owned Car? Click to find out more Industrial car insurance policy assists shield the company vehicles that your business owns.

Inexpensive Non-Owner Auto Insurance coverage was last modified: March 23rd, 2022 by host1stop Find the Least expensive Non-Owner Cars And Truck Insurance Serenity Insurance has guaranteeing chauffeurs utilizing Non-Owner Vehicle Insurance. Save big with from Tranquility Insurance coverage.

Upgraded April 19, 2022 What is Non-Owner Car Insurance Coverage? is for those that regularly locate themselves behind the wheel yet do not own a cars and truck. cars and truck insurance coverage adheres to the cars and truck, but in the instance of non-owner automobile insurance, the insurance coverage follows the vehicle driver. Considering that the insured does not possess an auto, there is no demand for other protections, such as detailed or crash.

Nevertheless, their liability insurance protection might be limited relying on what coverage they decided for. cars. This means that if you trigger a mishap where a person is seriously injured and don't have enough obligation insurance to foot the prices, you may be personally in charge of their clinical bills or vehicle repair work.

Fascination About Non-owner Sr-22 Auto Insurance Policy

If you have no economic interest in a car, it's tough for insurance policy companies to trust that you'll be motivated to take care of that vehicle. If you are in a state where this is not prohibited, you may be able to obtain insurance policy on an automobile you do not very own by adding the proprietor of the vehicle to your insurance plan.

cheapest auto insurance auto insurance cars perks

cheapest auto insurance auto insurance cars perks

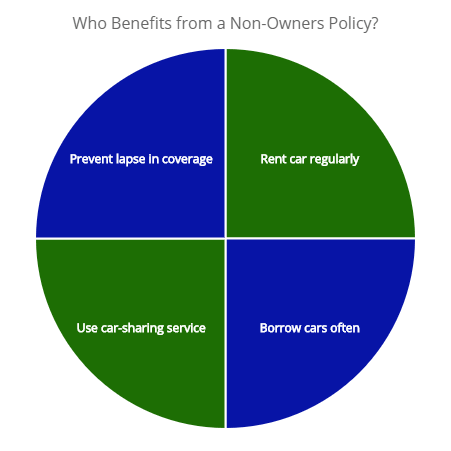

Taking out a non-owner vehicle insurance policy is going to be your finest wager. That Should Consider a Non-Owner Auto Insurance Coverage Policy?

That said, not everybody requires a non-owner car insurance policy. Drivers Who Regularly Rental Fee Automobiles or Use Car-Sharing Solutions Many states do need auto insurance business to provide some kind of obligation insurance with every cars and truck leasing.

2 (prices). Motorists Who Obtain Automobiles Regularly Borrowing an automobile from a loved one can be a wonderful method to prevent splurging by yourself car. That claimed, you go to the mercy of their insurance policy. If they happen to have reduced liability insurance coverage limitations, you'll be on your very own when it pertains to spending for expenses after an accident.

When you have your own policy, you'll reach select your precise coverage restrictions in addition to the firm you manage. 3. Motorists That Had Their License Revoked, Need to File an SR-22 and Do Not Possessed a Car An SR-22 is not a type of insurance; rather, it's just a type claiming that you have insurance policy coverage.

Some Ideas on Commercial Auto Vs. Hired And Non-owned Auto Insurance You Need To Know

Your insurance company will automatically send this form to your state's division of motor cars when you have a plan. dui. This is easy sufficient to figure out if you have a car as well as get an insurance plan on it.

4. Chauffeurs Who Sold Their Automobile yet Wish To Stay Clear Of an Insurance Protection Lapse A chauffeur who does not have insurance coverage for an extensive duration could have problem buying coverage once again or wind-up paying much greater rates in the future. An insurance firm might question why there was such a big gap in between policies, especially because it's legally called for in all states to keep cars and truck insurance coverage on your cars.

If you live with a person that possesses a cars and truck that you drive, instead than taking out a different policy, just have on your own added to their policy. By doing this, you'll get all of the protection of their plan without having to pay even more. 2. Chauffeurs Who Borrow a Car Rarely If you truly just obtain a cars and truck every now and then, it may not be worth it to have a non-owner insurance plan.

3. Chauffeurs That Drive a Company Automobile If you do every one of your driving in a firm automobile, you'll be covered by your company's insurance plan if you remain in a crash - dui. That claimed, if you're utilizing your firm vehicle for individual tasks, you must look into a non-owner insurance plan to cover yourself off the clock.

cheap car cheap car insurance cars cheapest auto insurance

cheap car cheap car insurance cars cheapest auto insurance

If there's a brand-new teenager chauffeur in your household without a vehicle and you are looking for young chauffeurs' insurance policy for them, their own non-owner's insurance plan is not a choice if you already have a vehicle. The teen motorist would require to be listed as a driver on your existing plan.

All About Non-owner Car Insurance - Usagencies

cheaper auto insurance car auto insurance

cheaper auto insurance car auto insurance

While having some violations on your driving record can boost your prices, you can still discover inexpensive non-owner car insurance coverage if you pick a supplier like Highway Insurance policy. Get a Non-Owner Automobile Insurance Quote Online Today Highway Insurance coverage provides affordable vehicle insurance coverage for non-car proprietors that you can rely on. affordable car insurance.

You don't own a vehicle, but that doesn't suggest you don't drive. Among the lots of kinds of auto insurance coverage, non-owner vehicle insurance is the one for you. Below you'll discover how a non-owner policy may profit you, and also what it costs in your state. Secret Emphasizes, Non-owner cars and truck insurance policy is more affordable than regular insurance it sets you back $474 a year, generally, based upon a rate analysis.

Geico has the least expensive automobile insurance coverage rate $311 per year, on average, for a non-owners policy. What is non-owner car insurance policy?

A non-owner policy will usually cost a lot less than a proprietor's policy. auto insurance. The low price is because vehicle insurance policy company threat is lower than that of an automobile owner that drives daily. The premium amount is, however, dependent upon regular rating variables, such as your driving document as well as where you live, so you can pay far more than that.

Why would you desire a non-owner policy?, though you would still require to acquire the accident damages waiver (CDW) to pay for repair work to the rental vehicle if your debt card firm does not instantly do so.

Unknown Facts About Non-owner Car Insurance- What Is It And How Does It Work?

As a risky chauffeur, the plan is usually required to please conditions to receive or reinstate a driver's permit - cheaper auto insurance. If you are needed to file an SR-22 or FR-44 with the state-- an insurance provider's guarantee that your coverage is present-- a non-owner SR-22 insurance coverage plan can satisfy that required even if you do not possess a vehicle.

As a matter of fact, if you obtain a good friend's automobile, you need to confirm that the proprietor has a plan that will encompass you as primary insurance coverage. Your non-owner protection would pay only on the occasion that the proprietor's insurance coverage restrictions are gotten to, and afterwards, only to cover the problems brought upon on the person or car you strike.

Protecting against a lapse in insurance coverage is a smart step due to the fact that automobile insurance provider usually charge you extra for a policy after a time period that you've had no insurance coverage. A gap in coverage for a week up to one month will trek your automobile insurance rate by an average of 9%, or about $130, a year.

Who should not acquire non-owner vehicle insurance? You possess a vehicle. Usually, in this circumstance you would certainly be called for to be placed on the auto owner's plan as a chauffeur to be covered rather of acquiring a non-owner policy of your very own.

You drive an automobile often. If you don't have a vehicle however drive somebody else's on a regular basis, you ought to be included to that person's policy as a vehicle driver. insurance affordable. If you remain in complete belongings of the automobile, find an insurance provider that will certainly permit you to position a routine vehicle insurance plan on that particular car.

What Is Non Owner Car Insurance? Can Be Fun For Anyone

A business non-owner plan, supplied by firms such as Progressive, might be much better matched for this need. You don't have a vehicle driver's permit and also can not obtain one within one month of beginning a non-owner plan - auto. Just how much does non-owner vehicle insurance price? Non-owner car insurance policy sets you back $474 a year, usually, based on a Car, Insurance coverage.

Right here's a look at the typical prices for non-owner automobile insurance policy by state: Exactly how much is non-owner auto insurance policy in The golden state? Here's how the expenses contrast between cities in The golden state: Who has the most affordable non-owners automobile insurance policy quotes?