Not all policies cover all extra expenses, nonetheless. Some utilize a coinsurance design. In this situation, the insurance provider pays a percent of expenses 80% or 90%, for instance. In that instance, you would certainly need to pay the staying balance, 10% to 20% of the prices utilizing the instance above. Common kinds of medical insurance plan deductibles consist of: Prescriptions.

insurers credit vehicle insurance trucks

insurers credit vehicle insurance trucks

In- and out-of-network care. If you obtain care from a health and wellness professional or medical center that's not included in your insurer's network of authorized suppliers, you may need to fulfill a separate, out-of-network insurance deductible, and that one can be greater than for in-network treatment. Family coverage. There are a number of different methods firms deal with family members health insurance coverage policies - business insurance.

This is referred to as an accumulated insurance deductible. Other insurance providers enforce what's called an ingrained deductible, in which each member of your family members need to satisfy a collection limitation before insurance coverage relates to their treatment (car insurance). Frequently asked questions, What is the distinction between an insurance costs and also a deductible? A costs is the price of your insurance policy protection.

The team does not keep examples, presents, or financings of service or products we examine - liability. Furthermore, we maintain a different organization group that has no influence over our approach or recommendations - insure.

Unknown Facts About Automobile Insurance - Official Website

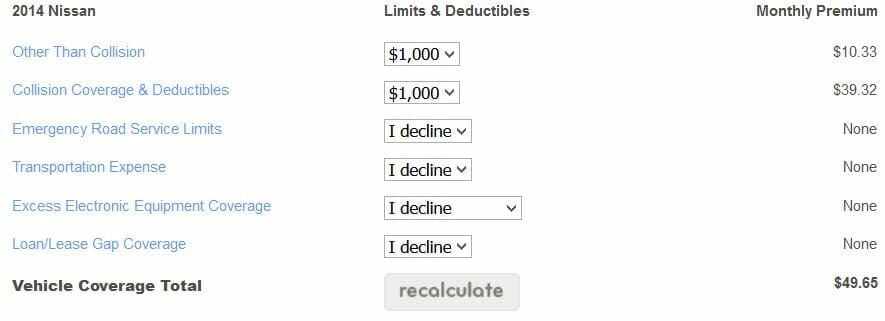

You are accountable for the initial $1,000 of damages and your insurer is accountable for the various other $1,000 of protected problems. Accident and also comprehensive are both most common protections with an insurance deductible. Collision-- this protection aids pay for damage to your car if it hits an additional cars and truck or object or is struck by one more car - cheapest.

There are likewise a few other points to understand regarding deductibles. There are no deductibles for liability insurance, the protection that pays the various other person when you trigger a mishap. Vehicle insurance policy deductibles relate to each accident you remain in. If you obtain right into 3 accidents in a policy period as well as have a $500 deductible, you'll normally be responsible for $500 for each case.

Talk with your Vacationer's agent or independent agent, regarding the best method to cover your vehicle. What is a Cars And Browse this site Truck Insurance Deductible? Your car insurance coverage deductible is the amount you'll be in charge of paying towards the prices because of a loss before your insurance coverage pays. suvs. The lower the deductible, the less you'll pay of pocket if an event happens. auto.

Selecting a greater insurance deductible may lower your car insurance costs. auto insurance. When Do You Pay an Automobile Insurance Policy Deductible?

Understanding Auto Insurance Fundamentals Explained

What Are Obligation Limits and also How Do They Work? Your car insurance coverage obligation insurance coverage restrictions, likewise referred to as limitation of responsibility, are the most your insurance coverage will certainly pay to one more celebration if you are legitimately responsible for an accident. Umbrella plans are not required and also available insurance coverage limits and also qualification needs might vary by state.

The typical car insurance policy deductible is the average quantity chauffeurs pay upfront when they have to sue with their auto insurance companies. After you pay this quantity, the insurance provider covers the expense of the certifying damage or loss. Picking an automobile insurance deductible can have major economic ramifications, so it is essential to evaluate the numerous alternatives with the assistance of an insurance coverage agent to make the ideal choice for you and also your household.

credit score suvs cheaper car car insurance

credit score suvs cheaper car car insurance

car insurance vehicle insurance risks trucks

car insurance vehicle insurance risks trucks

When you choose a higher deductible for your plan, you will certainly pay a reduced premium for protection (credit). Purse, Hub notes that you can save about 6 percent by picking a $2000 deductible instead of a $1000 deductible, which may or might not make good sense depending on the cost of your policy.

What Is A Car Insurance Deductible? - Bankrate.com Things To Know Before You Buy

If you have substantial cost savings, you could prefer to have a lower insurance deductible and a little greater month-to-month payment to avoid having to create a bigger sum in case of a mishap case. The Equilibrium blog site notes that you need to likewise consider your probability of having a case.

When buying for an automobile insurance policy, ask each agent to give you prices quote with various deductibles. If you would not be able to recover the expense of your insurance deductible within three years of a case with the lower premium, take into consideration choosing a lower deductible policy.

car insurance cheap car auto low-cost auto insurance

car insurance cheap car auto low-cost auto insurance

In a circumstance where you do not have the money to settle your insurance deductible to an auto mechanic, the insurance company will send you a look for the damage price quote minus the insurance deductible. However, you would certainly not have adequate funds to repair the damage to the lorry, which could substantially reduce its worth - car insurance.

You may be able to discover more information about this and comparable web content at (cheaper).

The Only Guide to Car Insurance 101 - Car Insurance Faqs - The General ...

Insurance deductible specified A deductible is the amount of money that you are accountable for paying toward an insured loss. When a calamity strikes your residence or you have a car mishap, the insurance deductible is subtracted, or "deducted," from what your insurance coverage pays towards a case (insurers). Deductibles are exactly how threat is shared in between you, the insurance holder, as well as your insurance firm.<</p>