Complete coverage car insurance coverage refers to a combination of insurance coverage coverages that shield a vehicle driver economically for damages to their vehicle, the owners of their vehicle, and also other vehicles and also passengers in a mishap. insurance. No insurance plan can cover you as well as your automobile in every possible scenario, yet full protection protects you in a lot of them.

Collision and extensive will protect you and also your vehicle if you enter a crash. credit. If you're located liable for a mishap. liability will certainly spend for problems you could cause to others. Nationwide says it is necessary to understand that full protection helps supply the ideal possible defense, but you still need to pay your insurance deductible if you trigger a crash.

This covers damages that are the result of lots of kinds of occurrences that take place when your vehicle is in movement. This covers damages to your vehicle that is not due to a crash (car insured).

What Are the Offered Coverages?, there are countless options for coverage, restrictions, as well as deductibles.

Without insurance driver protection as well as underinsured motorist coverage with limitations that match the liability protection in your policy for bodily injury. 4. Some states use uninsured motorist coverage for building damage. 5. All available coverages for clinical costs in the greatest amounts possible (affordable car insurance). This is called individual injury security in no-fault states, as well as it's called medical repayments insurance coverage in most other states.

Damage due to a natural catastrophe or burglary. What Does Not Full Insurance Coverage Insurance Pay For? Complete coverage insurance will certainly not cover:1.

Indicators on Liability Only Vs Full Coverages - Direct Auto Insurance You Need To Know

auto affordable car insurance cheaper perks

auto affordable car insurance cheaper perks

Destruction to the automobile or confiscation by government or civil authorities6. Willful damages What Are the State Minimum Requirements for Full Insurance Coverage? Every state can establish its very own minimum demands for automobile insurance.

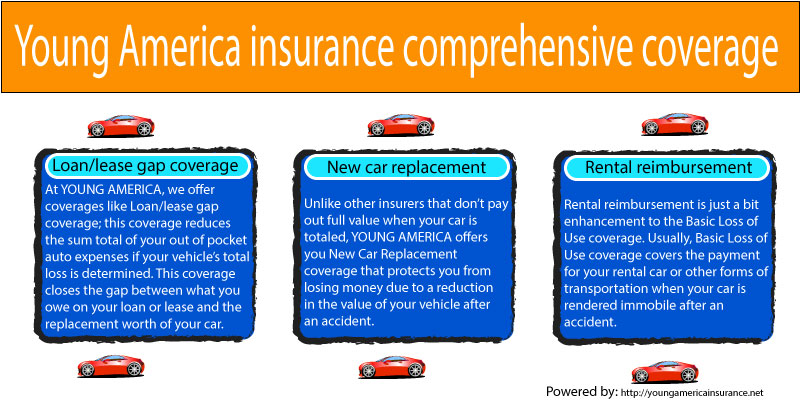

Extra protections for your car are not called for. Comprehensive Protection Comprehensive insurance coverage helps to pay for physical damage to the lorry or to replace it when the damage is not the result of a crash. It could be damage because of burglary, wind, hailstorm, or falling items such as a branch or a tree. car insured.

insurance insure vehicle accident

insurance insure vehicle accident

Accident Insurance coverage Collision insurance coverage is additionally component of full insurance coverage. This covers your automobile when it is damaged in a collision with an item or one more automobile. It will additionally cover your car if it is associated with a solitary rollover crash. Accident and also extensive coverage normally come as a bundle, so you do not get one without the other.

Rental Repayment Protection, Rental reimbursement protection is occasionally component of complete coverage - car. This covers a rental automobile while yours remains in the shop for repairs after an accident or a protected loss. The insurance coverage will usually hide to a collection buck amount each day for a predetermined variety of days.

money auto vehicle car insurance

money auto vehicle car insurance

What Is a Restriction? The protection restriction is the optimal dollar quantity that a cars and truck insurance provider will certainly pay for a covered insurance claim. Once the limitation is gotten to, the insured is in charge of spending for the remainder. It is necessary to remember that complete insurance coverage is not a kind of plan, but a mix of insurance policy protections.

This material is developed as well as kept by a third celebration, as well as imported onto this web page to aid customers provide their email addresses. You may be able to find more details concerning this and also similar content at (accident).

Facts About What Is Full Coverage Insurance? - Kemper Auto Revealed

Say your automobile requires repair services after an accident. Crash coverage aids pay to fix or change your automobile. Or, possibly your cars and truck is damaged, but not from a collision. If your vehicle is swiped or if something falls on it, that's where detailed coverage can be found in. Suppose your car remains in the shop after a protected insurance claim.

Prepared to start discovering your alternatives? Call an Allstate representative today (cheapest auto insurance).

Obligation insurance is just one part of a complete coverage insurance policy. Responsibility insurance policy is the part of your coverage that spends for injuries as well as problems you cause in an at-fault crash. If you hit a person else and they need to repair their auto or look for medical focus, your responsibility coverage is what pays for those expenses. risks.

There are other coverages you can purchase that can assist protect you and your vehicle, such as without insurance or underinsured motorist insurance coverage, injury security, or med pay, but they are normally not taken into consideration component of your responsibility protection - insurance. Unlike extensive and also crash protection, obligation insurance coverage is required by law in practically every state (credit score).

auto insurance affordable auto cheapest

auto insurance affordable auto cheapest

This is very based on your location, so call our professionals at Goosehead Insurance policy for more details regarding your particular Article source protection (car insured). Complete coverage insurance coverage covers at-fault accidents. If you struck one more car on the highway or face a guardrail, your accident insurance coverage will certainly spend for the damages to your automobile and your responsibility coverage will spend for the damages you caused in the crash (perks).

cheap car car insurance car insurance

cheap car car insurance car insurance

If you purposely struck somebody or something with your auto, those problems will certainly not be covered by insurance policy. It is alluring to change to an obligation just plan as quickly as your automobile payments are full, yet you should bring complete protection on any automobile you can not pay for to replace out-of-pocket in case of a failure.