The insurance coverage company will only spend for costs that surpass $1,000. So, you have to pay the whole $650. Deductibles often vary from $100 to $2,500. Amounts differ by insurance company and the kind of coverage you're purchasing. The typical cars and truck insurance policy deductible is $500, according to American Family Members Insurance. If you have more than one sort of protection with a deductible, you can pick various deductible amounts for each protection kind.

If you can't afford to pay your deductible, you will not be able to cover all the repair services. The insurance company will just pay for prices that exceed your insurance deductible.

If you think it's not likely you'll need to sue, you could consider a greater insurance deductible. Regardless of what amount you select, it is very important to ensure you can afford to pay it if you require to sue adhering to a mishap - trucks. Deductibles put on some kinds of auto insurance coverage but not to others.

This sort of coverage helps pay for repair service and also substitute costs if you remain in a collision (cars). Covers events that are out of your control and also do not involve a crash, such as severe weather, rodent damages, dropping things, theft, and criminal damage. Helps pay for lorry repairs if the at-fault motorist doesn't have insurance or doesn't have sufficient insurance coverage to cover the expense of the repair services.

This kind of insurance coverage is not readily available in all states. cheapest. If an insured chauffeur strikes you, you do not require to pay a deductible considering that the other motorist's insurance will certainly cover the damages. If you ever before need to submit an insurance claim with your insurance business, you will certainly be accountable for paying the deductible.

Your insurance deductible amount is something you will identify with your insurance policy agent or provider before completing your automobile insurance plan. What kinds of automobile insurance policy deductibles are there?

The 10-Second Trick For Raise Your Car Insurance Deductible To Lower Your Rates

But other coverages such as thorough, accident, injury defense and also uninsured driver property damage exist to assist cover injuries to those in your car and damage to your auto. These protections might have deductibles, or a minimum of the option to consist of a deductible to minimize the expense of protection.

g., utility pole, guard rail, mail box, structure) when you are at-fault. While crash insurance coverage will certainly not repay you for mechanical failure or normal wear-and-tear on your automobile, it will cover damage from pockets or from rolling your lorry. The average cost of accident coverage is usually around $300 annually, according to the Insurance policy Info Institute (Triple-I).

ComprehensiveOptional thorough coverage provides security versus theft as well as damages to your car triggered by a case aside from an accident - accident. This includes fire, flood, vandalism, hail, dropping rocks or trees and also various other hazards, such as hitting a pet. According to the Triple-I, the typical price of detailed coverage is commonly less than $200 each year.

This protection is not available in every state, however it might have a state-mandated insurance deductible amount in those where it is (cheap insurance). In cases where a deductible uses, it is usually low, between $100 to $300. Individual injury protection, Relying on your state, you might have accident protection (PIP) insurance coverage on your policy (auto).

It can also aid cover expenses associated with lost incomes or if you require someone to do house jobs after a crash because you can refrain from doing so. accident. Depending upon your state, you may have a deductible that applies if suing under this insurance coverage. Several states with PIP deductibles provide numerous choices follow this link to pick from, as well as the deductible you select can affect your costs.

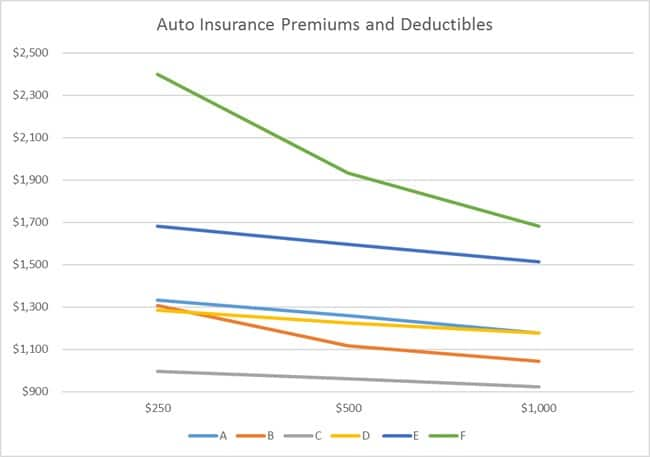

The majority of companies use alternatives for $250, $500, $1,000 or $2,000 deductibles. Some auto insurance provider offer various alternatives for deductibles, including a $0 or $100 deductible. Your detailed and also collision protections do not need to match, either; it is not uncommon to have a $100 comprehensive insurance deductible however a $500 accident insurance deductible, or a $500 thorough deductible and also $1,000 accident insurance deductible.

Fascination About What Is A Car Insurance Deductible? - Insurance Navy

Normally, the reduced the deductible, the higher your insurance costs. It is vital to consider your total monetary health and wellness when picking a deductible. liability. Aspects to think about when selecting an automobile insurance deductible, There are numerous points to consider when picking your auto insurance policy deductible amount.

However, you can spend extra on your premium by having a lower insurance deductible and never finish up filing an insurance claim. This is the nature of having insurance protection and an instance of the threat both you as well as the insurance company tackle. Just how much can you manage to pay out of pocket? Prior to you pick an insurance deductible, it is very important to figure out what you can afford to pay if your auto is harmed in a crash.

If you do, you might not have the ability to afford to repair your vehicle if you are at mistake and require to pay the insurance deductible for fixings. Does your lender have deductible demands? If your automobile is financed or leased, you will probably need to bring thorough as well as crash protections for your car.

Some lenders will certainly have an optimum insurance deductible that you are enabled to bring for extensive as well as collision. It is essential to get in touch with the banks that handles your funding or lease to identify if these restrictions exist. When are you not required to pay your auto insurance coverage deductible? There will be events when you are not required to pay your insurance deductible, but those are infrequent.

Your deductibles only apply when suing with your insurance firm. If you have a decreasing deductible, Some insurance provider use a lessening deductible, or disappearing deductible, option. If you have this policy feature, the longer you do without a mishap results in a reduction in the quantity you would certainly need to spend for your deductible.

So, for instance, if you have a $500 collision deductible and do not have a mishap for 4 years, you could obtain a $100 reduction every year. If you required to file a claim, your insurance deductible would certainly be $100 instead of the original $500. When you utilize your reducing deductible, there is usually a time period to receive it again.

Types Of Deductible In Car Insurance - Digit Can Be Fun For Anyone

Often asked concerns, What does it mean when you have a $1,000 collision insurance deductible? If you have a $1,000 insurance deductible, you will certainly pay $1,000 out of pocket if you have actually an accepted case covered under crash. cheapest. For instance, if you submit an insurance claim for $5,000 well worth of repair work, you will certainly pay $1,000 as well as the insurer will certainly pay $4,000.

Your physical injury obligation and also property damages responsibility will certainly spend for the damages to the other event, and also those coverages do not have an insurance deductible (low cost). Yet if you have accident insurance coverage as well as you desire the insurance coverage business to action in to cover the repair services to your vehicle, you will certainly have to pay your collision deductible.

If the crash was the various other driver's fault, their obligation insurance coverage need to spend for your problems as well as you need to not have to pay a deductible. If the various other driver is without insurance or underinsured, you might be liable for paying a deductible depending on how your protection applies to cover the costs.

Your insurance provider will certainly pay for your damages, minus your insurance deductible, and after that ask the at-fault driver's insurance firm to pay the money back in a procedure called subrogation. dui.

Your vehicle insurance deductible is normally a set quantity, say $500. accident. If the insurance insurer determines your case amount is $6,000, and you have a $500 deductible, you will obtain a claim payment of $5,500. Nonetheless, based upon your insurance deductible, not every cars and truck mishap warrants a claim. If you back right into a tree causing a tiny dent in your bumper, the expense to fix it may be $600.

Deductibles vary by policy as well as motorist, and you can choose your car insurance policy deductible when you acquire your plan.

The What Is An Insurance Deductible? PDFs

Compare quotes from the top insurance coverage firms. Which Automobile Insurance Policy Coverage Types Have Deductibles? Equally as there are different kinds of automobile insurance policy protection, there are varying deductibles based upon those various kinds of insurance coverage. It's vital to recognize how much the car insurance deductible is for every type, so you'll recognize what you're expected to pay in case of a case.

Obligation auto insurance protection does not have a deductible. This insurance coverage pays your expenses if your car is harmed by something various other than an accident with one more car or things. This can consist of repairing damages from hailstorm, striking a deer or changing a cracked windshield. It additionally will pay to cover the price of replacing taken items.

This coverage spends for repair services to your lorry when you are at mistake. This might be when your auto is damaged in an accident with another car or a things such as a tree or wall surface - credit score. This deductible is generally the highest possible insurance deductible you will certainly have with your automobile insurance plan (insure).

Because case, you would not pay a collision insurance deductible. Injury protection coverage pays the medical expenditures for the driver and also all guests in your vehicle. Without insurance motorist protection pays your costs when you remain in an automobile accident with a chauffeur that is at mistake yet does not have insurance or is insufficiently guaranteed to cover your costs.

Because consumers pick varying kinds of auto insurance policy protection with different monetary limits, deductibles can vary dramatically from one motorist to the next. According to Cash, Geek's information, the typical automobile insurance policy deductible amount is roughly $500.

Your automobile insurance coverage deductible will certainly differ based on that protection and also the expense of your premium. Typically talking, if you pick a policy with a greater deductible, your premium will be lower. This can be a fantastic option as long as you can pay that higher insurance deductible in case of a mishap.

Zero Deductible Car Insurance - Truths

You can save a standard of $108 per year by boosting your insurance deductible from $500 to $1,000. insure. For those with limited spending plans, picking a reduced costs as well as a higher insurance deductible can be a way to guarantee you can pay for your automobile insurance policy. If you can manage it, paying a greater premium might indicate you do not have to come up with a great deal of money to pay a lower deductible in the occasion of a mishap.

It is necessary to have your inquiries relating to car insurance deductibles addressed prior to that takes place, so you understand what to expect. Broaden ALLWho pays a deductible in a mishap? Do you pay if you're not to blame? When there's a car crash, the at-fault chauffeur is called for to pay the cars and truck insurance coverage deductible.